On the First 5000. 13 September 2018 Page 1.

Higher Corporate Taxes Affect Everyone

Any Loan Taken Or Repaid 20000 In Cash.

. Computation of income tax format in excel for fy 2017 18. You can also get a tax year overview. 102018 Central Tax Rate This notification extend date of exemption to 30 June 2018.

IT Computation in PDF Format Go to Transactions menu Under IT. Company with paid up capital more than RM25 million. Reproducible Computation By Paul Abbott Jan 7 2022.

Withholding Tax Tables for 2018 February 2018 According to the Taxation Administration Ministry of Finance a new Tax Withholding Table for the year of 2018 is effective on January 1. 83 Computation of adjusted incomeloss from a business source 831 The computation of adjusted incomeloss from a business source is as follows. The flowchart format of computation of total income in relation to an individual is as in APPENDIX A.

December are calculated based on the corporate income tax. Name of Company Year of Assessment Note 1 Basis Period Note. Corporate income tax in Malaysia is applicable to both resident and non-resident companies.

PART III COMPUTATION OF INCOME TAX AND TAX PAYABLE Public Ruling No. 10 years in academic writing. 33 taxable income and rates.

COMPANY TAX COMPUTATION - FORMAT ADD LESS RM RM NET PROFIT BEFORE TAX XX LESS. On the First 20000 Next 15000. These columns are included for the detailed income tax.

Companies are taxed at the 24 with effect from Year of Assessment. The form c is a declaration form for a company to declare its income whereas. The standard corporate tax rate is.

An effective petroleum income tax rate of 25 applies on income from. Public sector taxation and market regulation. Malaysia Payroll And Tax Activpayroll Accounting Dubai Accounting Services Accounting Firms Financial Accounting How A Perfect Gst Tax Invoice Should Look Like Eztax In Gst Help.

Income TaxWealth taxInt On TaxPenalty On Tax Shown As. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. 62018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

Any Cash Payment 20000 Of Any Expense Per Day. Tax Rate Of Company. Company with paid up capital not more than RM25 million On first RM500000.

Income Tax PAYE - the monthly income tax amount which is based on the tax payable monthly EQV and tax payable annual columns. On the First 5000 Next 15000. RM RM Gross income from.

Basic Format of Tax Computation for an Investment Holding Company To be used as a guide only Tax Reference No. NON BUSINESS INCOME X Dividend received As per.

A New Wave Of Innovation Hubs Sweeping The World

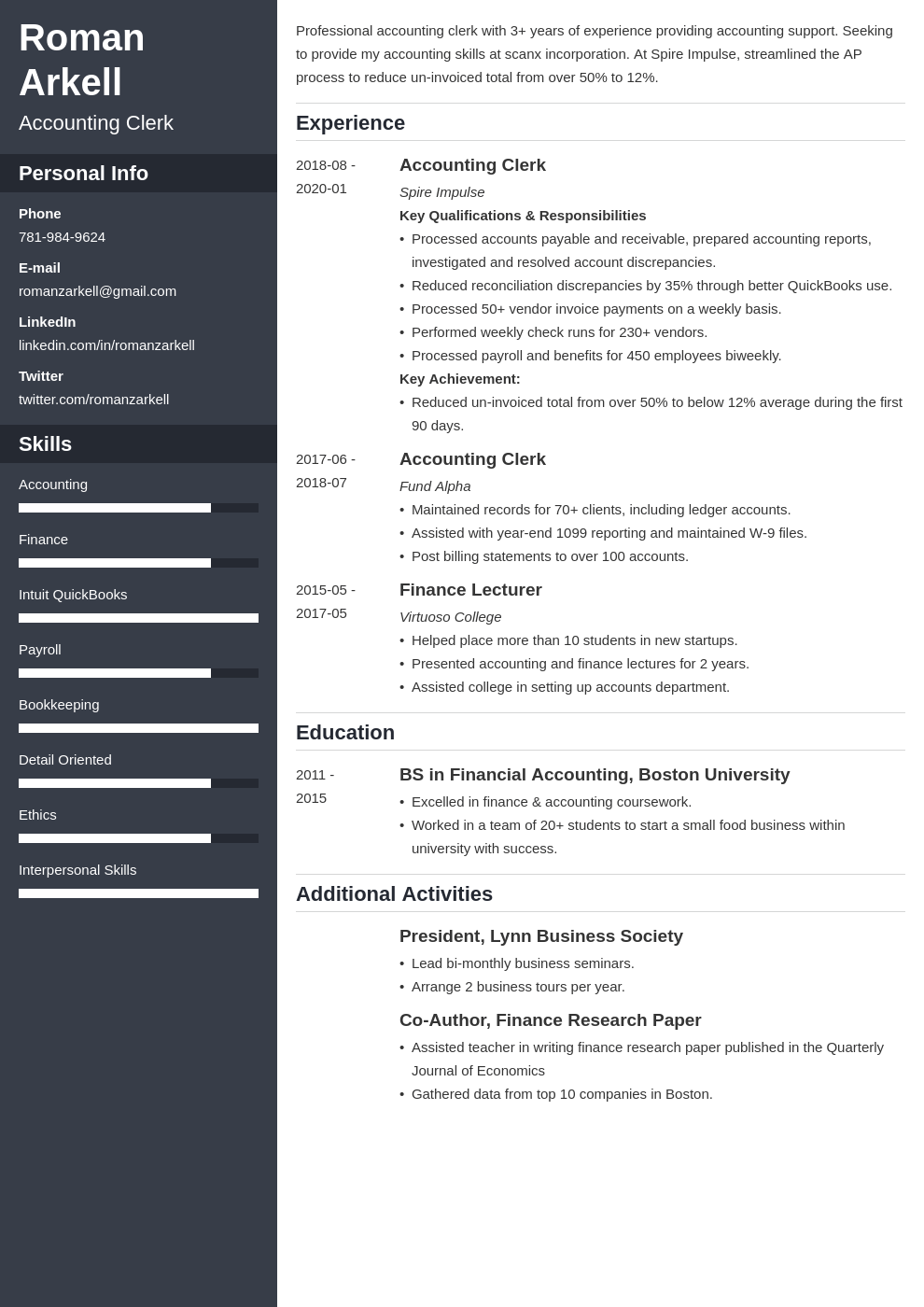

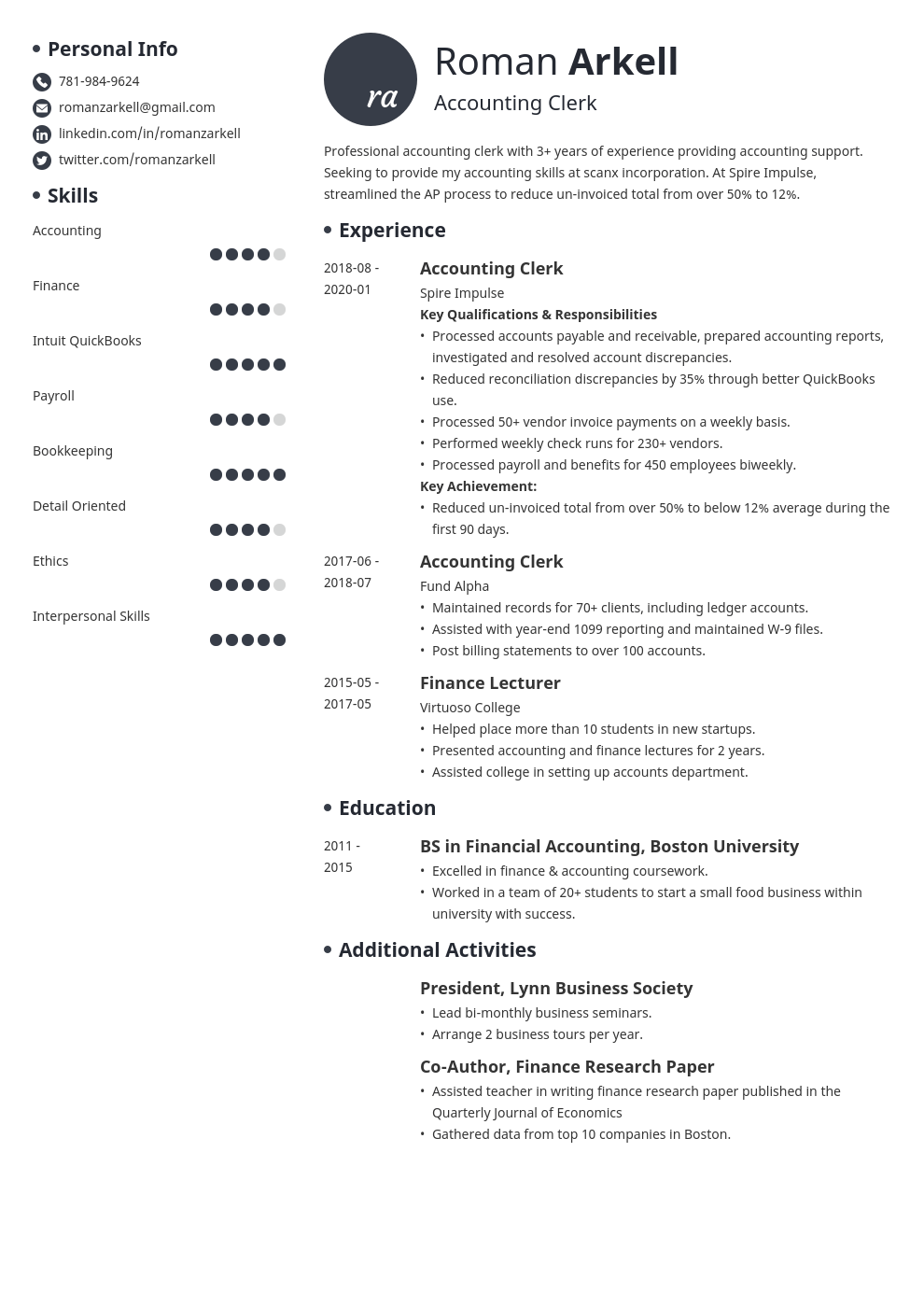

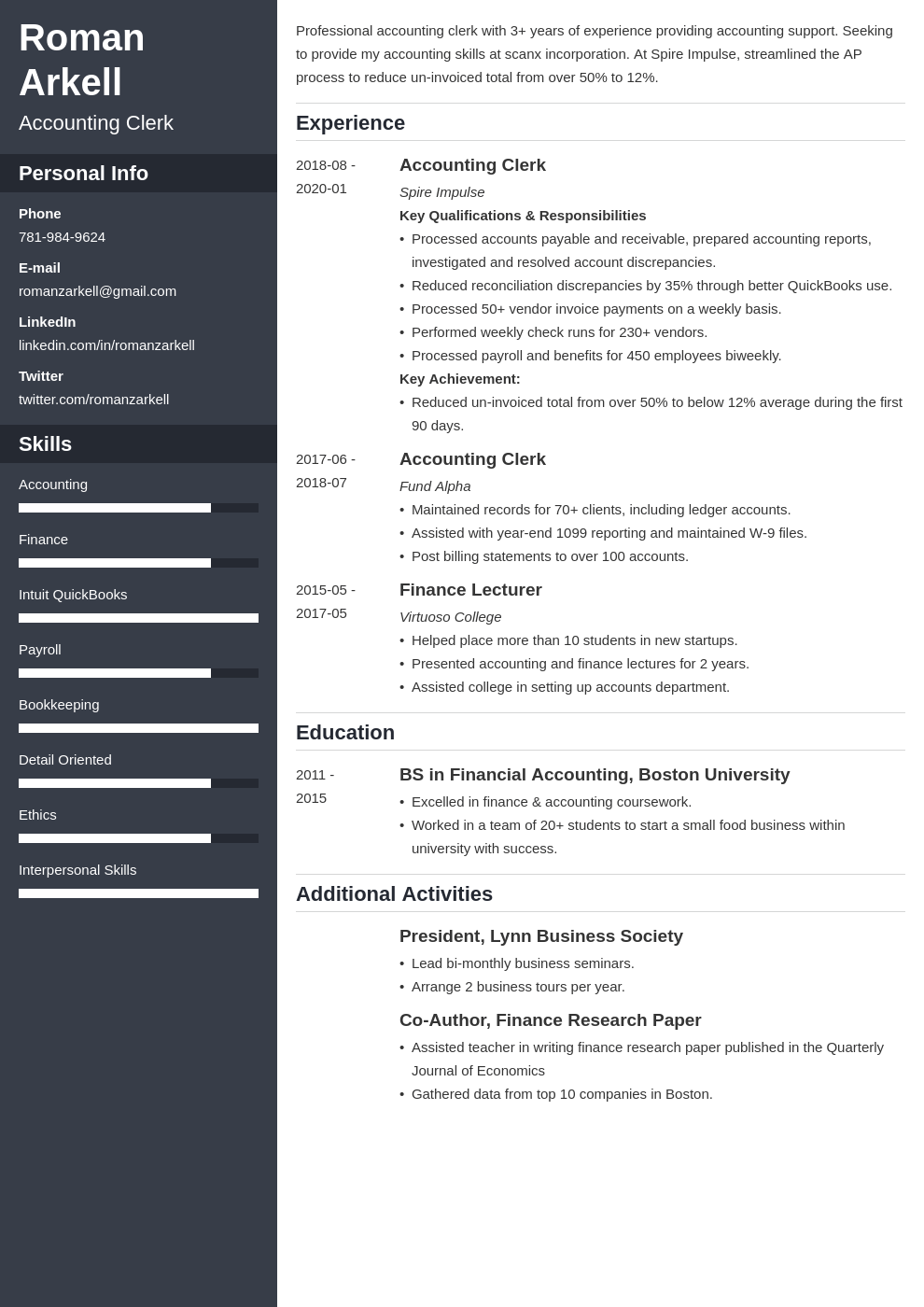

Accounting Clerk Resume Sample Job Description 20 Tips

Taxation Images Browse 889 169 Stock Photos Vectors And Video Adobe Stock

Capital Gains Tax Rate Types And Calculation Process

Taxation Images Browse 889 169 Stock Photos Vectors And Video Adobe Stock

The Challenge Of Accounting For Goodwill The Cpa Journal

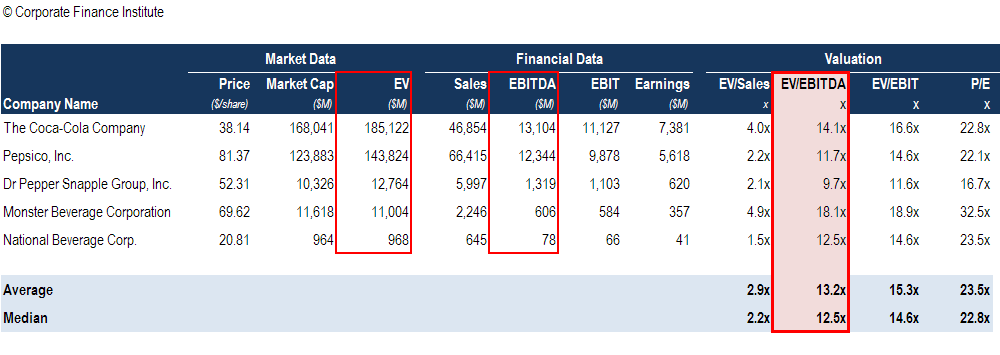

Ebitda Multiple Formula Calculator And Use In Valuation

Irs Releases New 2018 Withholding Tables To Reflect Tax Law Changes

Accounting Clerk Resume Sample Job Description 20 Tips

/accounting_shutterstock_503645956-5bfc3251c9e77c002631a3d4.jpg)

How Effective Tax Rate Is Calculated From Income Statements

Do You Need To File A Tax Return In 2019

Accounting Clerk Resume Sample Job Description 20 Tips

Accounting Clerk Resume Sample Job Description 20 Tips

Irs Releases New 2018 Withholding Tables To Reflect Tax Law Changes

A Review Of Exploration Development And Production Cost Offshore Newfoundland Springerlink

Form Cp500 Lhdn Cp 500 Guidelines Of Cp500 Payment